Kat had recently closed on her Betenbough Home when she received a letter explaining that the county over-valued her property and Betenbough Homes wanted to help her save on taxes. She was confused and called our Property Tax Hotline for more information. Maya Hagan, business support coordinator, answered that call and explained that we wanted to represent her by appealing her property tax appraisal to the county. Kat was shocked and incredibly grateful that we would do that for her. Maya told her that it’s all part of Betenbough’s mission.

To understand what prompted Kat’s phone call to our Property Tax Hotline, let’s rewind this story.

In the pursuit of excellence and constant improvement, Impact Title has been working to increase the accuracy of their property tax prorations for our home buyers. The team worked with the Central Appraisal Districts (CADs) in each of the four counties where we build homes to help them consistently and accurately value our homes.

The Impact Title team, together with the Betenbough analytics team, the accounting team, and the construction coaching team, collaborated to organize enormous amounts of data from several systems into a spreadsheet that shows precisely the cost of each home we build and the percent completion for each home as of January first.

We provided custom spreadsheets to each of the CADs, and they agreed to value our homes based on the data we provided.

When the property tax valuations came out in the spring, however, the CADs had not followed our numbers. The appraisals came in higher than we expected. While this is common and we had no obligation to intervene, our homeowners would be stuck paying the difference. We decided to get involved and save our homeowners money.

We protested the tax appraisals on the new homes in every region. That amounted to about 480 homes—no small task.

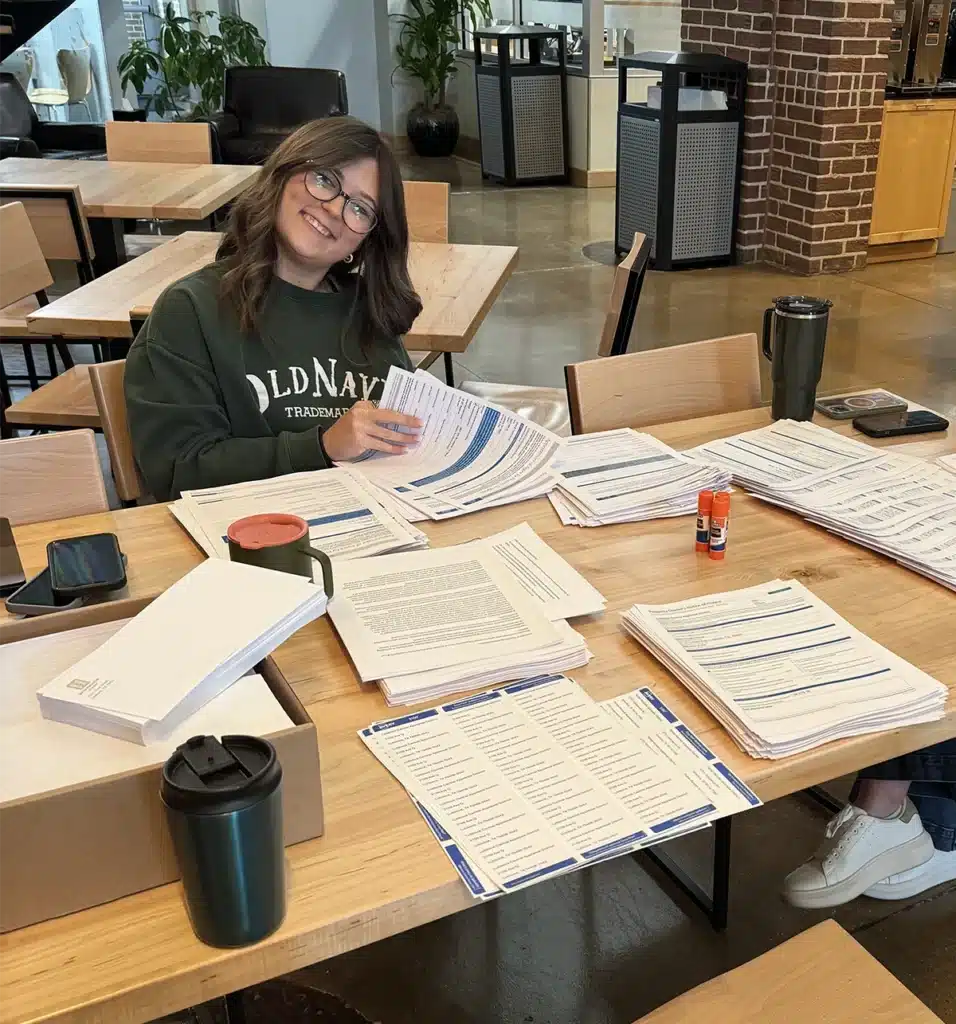

First we had to obtain permission from each homeowner to represent them to the CAD in their county. Next we had to file a protest for each home. The correspondence for those two steps alone was an enormous project. Frank Babb, IT systems engineer, helped streamline the process. The entire accounting department helped fold and stuff envelopes. The connections team got involved. Bryce Crum, land analyst, even joined in when he saw the need!

The entire subject of tax appraisals is intimidating and confusing to many homeowners, so some struggled to understand our letter explaining the situation. Many couldn’t believe our company would go to such lengths to help them when they’d already closed on their home. We set up a Property Tax Hotline for customers to call with questions and concerns, and that’s how Kat ended up speaking with Maya.

Jobe Rodgers, Impact Title real estate attorney, said, “The time-cost analysis of what we spent on this project is tremendous. I’m still so glad we did it. Not many companies, if any, would do this for their customers.”

As the hearings approached, our teams were hard at work gathering receipts for every expense that went into each property being protested. Jobe went to the Appraisal Review Board hearings with Maya and accounting manager Jarisa Larsen. They took boxes of paperwork with them to back up their values for each home.

Thanks to the team’s hard work, we won the protests for every home in Midland, Ector, and Randall counties. We won eighteen of the thirty-three protests in Lubbock county.

We saved homeowners tax dollars in every protest we won, putting between $100 and $5,000 back in the pockets of each.

This project exemplified generous stewardship. It required an openhanded sharing of resources between our businesses and teams, with the CADs, and with our home buyers.

“We truly care about our home buyers. It’s what the Lord put in front of us to do.”

– Jarisa Larsen

Betenbough invested an enormous amount of manhours in this project, knowing the savings would ultimately go to our homeowners. The savings we won for them in 2024 totaled $100,000!