This story is one example of how we try to do business very differently than most places and always try to do the right thing for our customers – even when they aren’t aware there was ever a problem.

To understand the story, you need a little context: When we sell a home to a customer, we agree to pay the property taxes for the portion of the year we owned the property, and they’re responsible for the portion of the year after their closing date. As the title company prepares for the closing, they will estimate what that year’s property taxes will be, and at closing, they will charge the builder for their portion and pay it out to the buyer. That’s called “tax proration.” The concept isn’t complex, but you might be surprised to hear that how each title company does these estimates is a little different. There isn’t a standardized approach or calculation. The government doesn’t issue the actual property tax bill until October, so homes that close before that in the year are based on estimates. The estimates rarely match the final property tax bill exactly, but they are typically close.

Around May 2023, Impact Title general manager, Rynn Day, Impact Title real estate attorney, Jobe Rodgers, and other Impact Title team members were auditing some of their processes, and they found a potential issue with how we’d been estimating tax proration for some homes. They brought Jeanna, Cal, and Kalee from the Betenbough Homes senior leadership team in on the discussion to collaborate on what our process should be for that. Our biggest concern quickly became that maybe we hadn’t paid our fair share of the property taxes and that customers could be blindsided with a higher bill at the end of the year. After an in-depth analysis of all the homes, we found that, on average, we were within $25 of the final property tax bill, and it was in the buyer’s favor (meaning we were paying more than our fair share). Knowing all of the complexity that goes into appraised property values and tax estimates, being within $25 on average is extremely accurate, and we were really proud of that.

However, we dug a little further into the numbers, and while, on average, we were very accurate – there were also many outliers where we’d overpaid our fair share and others where we’d underpaid our fair share. The majority were off by $100-400, but a handful were over $1,000!

Even though we know virtually none of those customers would ever know about that mistake or ask us to repay them, we were convicted that we should make it right. We decided that for any of those we underpaid, we’d figure out exactly what our portion should have been and then proactively send them a check. And on the other side, for the list of customers where we paid more than our fair share, we wouldn’t go back and ask them to repay us.

To be clear, we had no legal obligation to do anything, and Harvard Business School professors would think our decision was nuts! But, we chose to do the right thing for the customer despite the fact that it would directly reduce our net profit.

So, over the next few months, Impact Title spent time going back through homes that were affected and re-calculating the tax proration in a more accurate way, and then Betenbough Homes cut checks to 177 homebuyers for a total amount of $75,555.

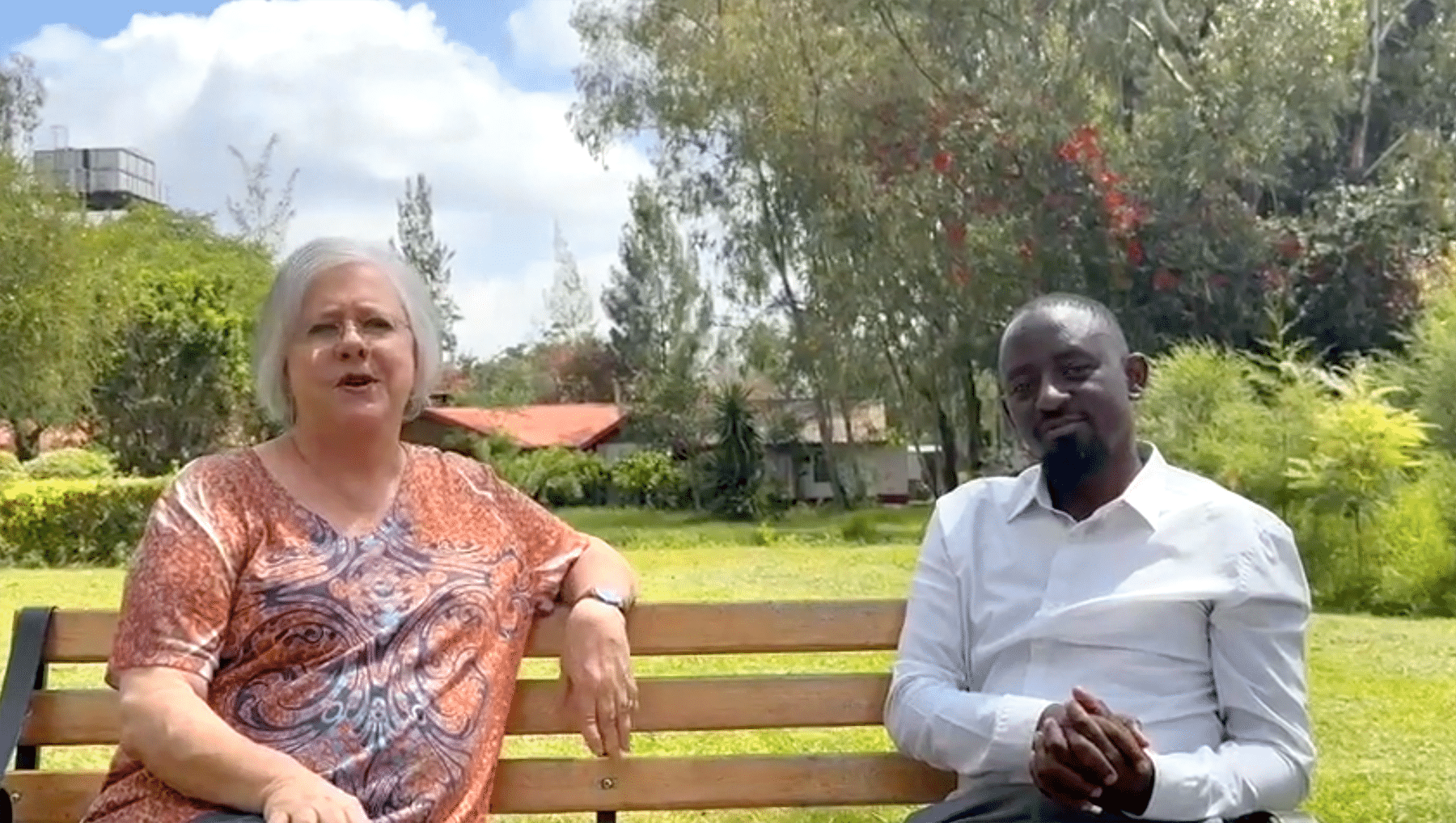

Jobe Rodgers is our full-time Real Estate Attorney at Impact Title. Jobe has run other title companies and has vast industry experience, and here is his take on how counter-cultural our actions were:

“In my 18-year career, I have never seen a seller or builder proactively seek to refund to their buyer an adjusted tax proration, and I have never seen a title company work so hard to get the number correct. I am incredibly thankful to our leadership for having a heart for doing what is best for the homebuyer, not for the bottom dollar.” – Jobe Rodgers

We chose to reduce our 2023 net profit by over $75,000 – purely for the benefit of the customer. They didn’t ask for it. But, if it were one of us living in one of those homes that we discovered the issue on, we would hope that is what someone would do for us – so that’s what we did for our homeowners.

“Jesus replied: ‘Love the Lord your God with all your heart and with all your soul and with all your mind.’ This is the first and greatest commandment. And the second is like it: ‘Love your neighbor as yourself.’ All the Law and the Prophets hang on these two commandments.” – Matthew 22:37-40

“Many people don’t believe that true altruism exists, meaning they don’t believe someone would ever do something for someone else if they weren’t getting something in return. They don’t believe that people can truly be selfless. And honestly, I’m not sure altruism does exist – apart from Jesus. Here we believe this is God’s company and that we are simply stewarding his resources. If Jesus was in those meetings with us, we’re convinced this is what he’d suggest we do. So that’s exactly what we did!” – Cal Zant, Betenbough Homes President

This is simply one example of the type of operational decisions that happen all the time within our companies. Betenbough Homes and Impact Title worked together, and we chose to take care of people over maximizing our profits. Rarely, if ever, does a normal business make that decision, especially over $75,000 – but that is one way we were able to “Reveal God and His Kingdom Through Our Work In The Marketplace” in 2023.